EIC evaluates that the 2020 crisis will have a widespread impact on labor,

potentially prompting historic high unemployment levels

and exacerbating household vulnerability.

- Thailand is stuck in an unforeseeable economic turmoil provoked by the infectious spread of the COVID-19. The impact has been heavy on nearly all economic sectors with fatal implications on tourism-related sectors. The current situation has put additional pressure on the already-weak labor market. Labor groups with the highest perceived risks due to high sensitivity to economic conditions include part-time workers, freelancers, self-employed, and SME employees, which accounts for 62% of Thailand’s labor force.

- EIC estimates the number of unemployed persons will surge to 3-5 million persons, prompting Thailand to witness the highest unemployment figure among all past crises in its history. This is because the impact is more widespread and in tandem with a sudden stop of various economic activities. Meanwhile, the agricultural sector may not be able to absorb unemployment from other troubled sectors as in the past due to the drought problem.

- EIC views that although many workers may still be employed, they tend to be handicapped with lower working hours and lower income. Some may even make no income during some periods. As such, the labor market recovery is expected to be slow following a U-shaped recovery of the economy and the impact of COVID-19 that will remain as long as there is no effective medicine and vaccine available.

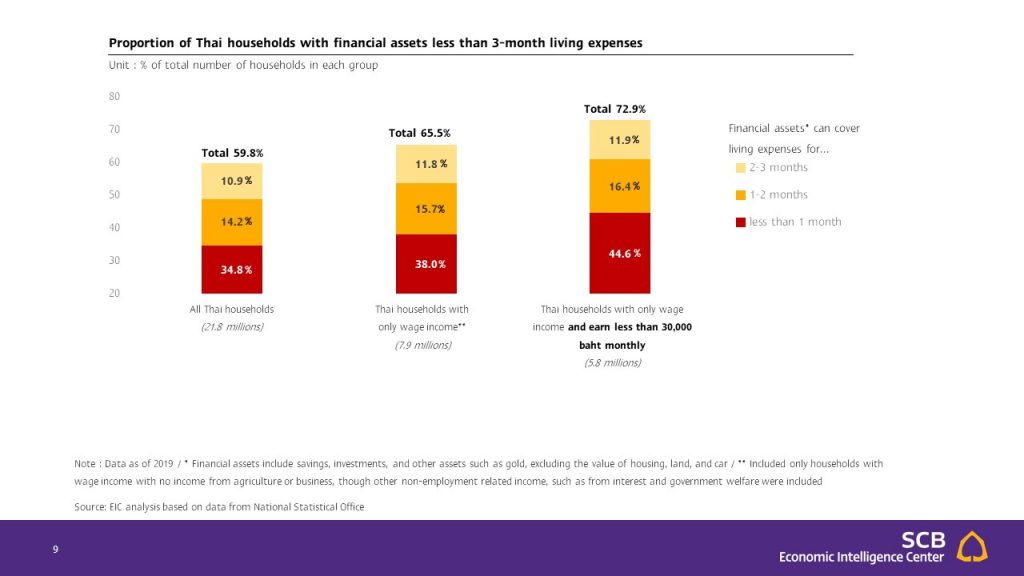

- The risks in the labor market could spill over to affect the quality of life of the already-vulnerable household sector. Currently, around 60% of Thai households possess insufficient financial assets to cover for over 3 months of expenses.

EIC found that the Thai labor market signaled various vulnerabilities even before the occurrence of the COVID-19 pandemic as follows:

- Lower number of employed persons. According to the data from the National Statistical Office, the number of employed persons in Thailand continued to decline during recent years. In 2019, the average number of employed persons was at 37.6 million, dropping by 480 thousand persons from 2014. The decline could be explained by both cyclical and structural issues. Key factors included the recent economic slowdown, a cyclical factor that lowered labor demand, in addition to the structural issue of growing number of elderly citizens leaving the workforce from 5.4 to 6.8 million persons during the same period. The average number of employed persons during the first quarter of 2020 continued to drop to 37.4 million persons, declining by -0.8%YOY and representing a 4 consecutive quarters decline.

- Lower number of working hours. The average number of working hours among Thai workers in 2019 was at 42.7 hours per week, declining from the average 44.1 hours per week in 2014. The drop spurred from lower overtime workers (workers with 50 working hours or more per week). Such workers dropped from 9.7 to 6.8 million or accounting for 2.9 million during the mentioned period. The declining working hours trend was also evident during the first quarter of 2020, as the number of overtime workers continued to drop by -7.6%YOY.

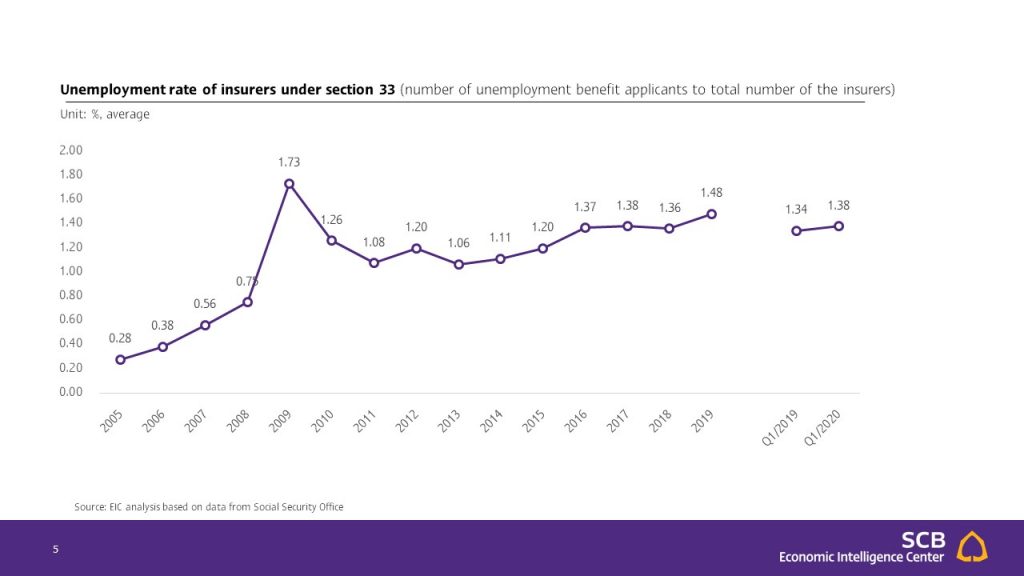

- Higher number of unemployed persons. The average number of unemployed persons during the first quarter of 2020 was at 396 thousand persons, increasing by 14.8%YOY. The growth marked 3 consecutive quarters increase. Furthermore, according to the data from Social Security Office, the average number of insurers that were unemployed as of the first quarter of 2020 was at 160 thousand persons, increasing by 4.5%YOY. As a result, the unemployment rate of the insured persons continued to increase since 2013 (Figure 1).

Table 1: Thailand’s labor force survey

Note: *majority were too old

Source: EIC analysis based on data from National Statistical Office

Figure 1: Unemployment rate of insurers under section 33 (number of unemployment benefit applicants to total number of the insurers) Unit: %, average

Source: EIC analysis based on data from Social Security Office

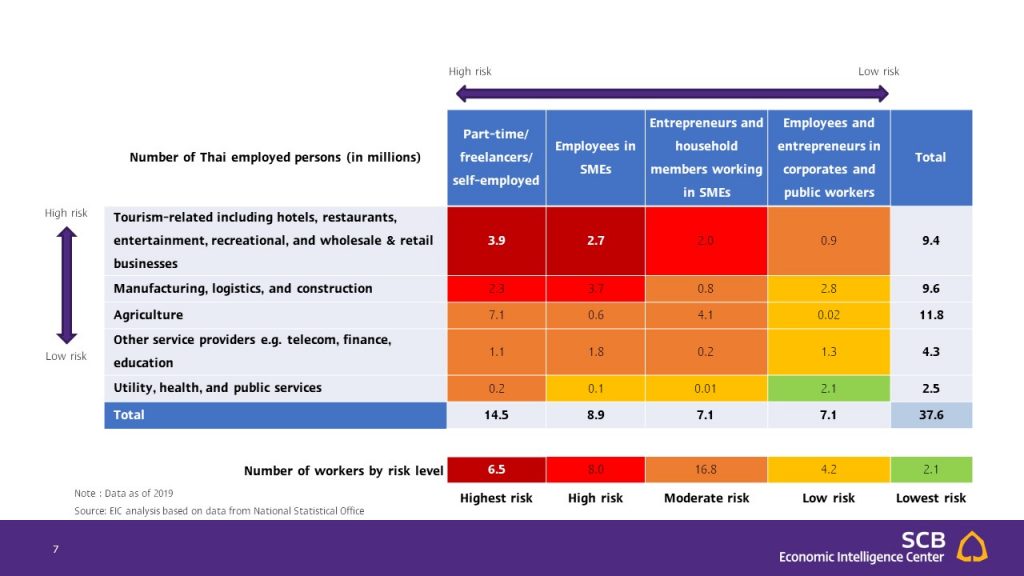

In addition to the existing labor market vulnerability, various negative factors, namely, the spread of COVID-19 breakout, the slowdown in the global economy, and the ongoing impacts of the drought, are widely undermine the labor force conditions in various industries. Workers with the highest perceived risks will be ones working in tourism-related industries including hotels, restaurants, entertainment, and wholesale and retail businesses. Such businesses should be directly impacted by the falling numbers of tourists and the lockdown measures. Meanwhile, other sectors will also be significantly affected, both directly and indirectly from severe economic recession with a likely u-shaped recovery. Workers in the agricultural sector will be directly hindered by the harsh drought and indirectly hampered by declining purchasing power. As such, during the current crisis, the agricultural sector may not be able to absorb unemployment from other troubled sectors as in the past.

More importantly, EIC views that employment type is another important factor that can dictate income vulnerability and job security. Part-time workers, freelancers, self-employed, and SME employees, which totaled 23.4 millions or 62.2% of total employment, are usually most sensitive to economic conditions and have comparatively higher risks among all business fields.

When considering both the business and employment type, workers with the highest risks are part-time workers, freelancers, self-employed, and SME employees who are working in the tourism industry. The total number of workers in the mentioned categories accumulated to 6.5 million persons, or accounting for 17.3% of total employment. Meanwhile, tourism-related SME businesses should be the following group with high risk, followed by workers in the mentioned employment types in manufacturing, logistics, and construction industries. Employees in large companies and public sector should see lower risks, however, such group of employees are only a small part of the labor force (Table 2).

Table 2: Risk levels of Thai labor during the 2020 economic crisis

Note : Data as of 2019

Source: EIC analysis based on data from National Statistical Office

From the mentioned risks, EIC estimates that the unemployment figure can surge to 3-5 million persons, lifting the unemployment rate to 8%-13% of the current workforce. The expected unemployment rate will be the highest unemployment figure since 1985, surpassing the previous record at 5.9% in 1987 and significantly higher than in the past crises such as during the Tom Yum Kung financial crisis (the rate was 3.4% in 1998) and during the previous global financial crisis (the rate was 1.5% in 2009). The key reasons that the unemployment rate could surpass the rate from previous crises are the wider impact on the already-weak business and household sector, the lockdown measures which help prevent further spread of the virus but caused a sudden stop in various economic activities, and the severe drought that disabled the agricultural sector to absorb employment from other troubled sectors as in the past.

EIC views that although many workers may still be employed, they tend to be handicapped with lower working hours and lower income. Some may even make no income during some periods. If the situation is prolonged to the second half of 2020 or later, the unemployment rate could exceed the projected rate mentioned. Increasing business closures will catalyze the unemployment upsurge, especially from businesses in the high-risk sectors with insufficient liquidity.

EIC views that after the lockdown measures are eased, the labor market situation should improve, though at a very slow rate following the U-shaped economic recovery. Furthermore, the economic and living standards will continue to be edged down by the COVID-19 pandemic as long as no effective medicine and vaccine are present. Under such uncertain circumstances, the business sector should continue to be cautious in spending and in employment decisions.

Loss of income and employment will inevitably distress numerous households due to their low financial buffer. According to the Household Socio-Economic Survey in 2019, the number of Thai households that solely depended on wage income was 7.9 million households, which accounted for 36.2% of total households. Of which, 5.2 million households or 65.5% possessed insufficient financial assets to cover for over 3 months of living expenses. Furthermore, the number of households with only wage income that received less than 30,000 baht per month was at 4.3 million from a total of 5.8 million households or 72.9% owned insufficient financial assets to cover for over 3 months of expenses (Figure 2). The current situation will trigger these households to adapt by reducing consumption significantly, selling or mortgaging available assets, or even borrow more in order to pay for living expenses, which will further exacerbate the household vulnerability going forward.

Figure 2: Proportion of Thai households with financial assets less than 3-month living expenses Unit : % of total number of households in each group

Note : Data as of 2019 / * Financial assets include savings, investments, and other assets such as gold, excluding the value of housing, land, and car / ** Included only households with wage income with no income from agriculture or business, though other non-employment related income, such as from interest and government welfare were included

Source: EIC analysis based on data from National Statistical Office

More information… https://www.scbeic.com/en/detail/product/6776